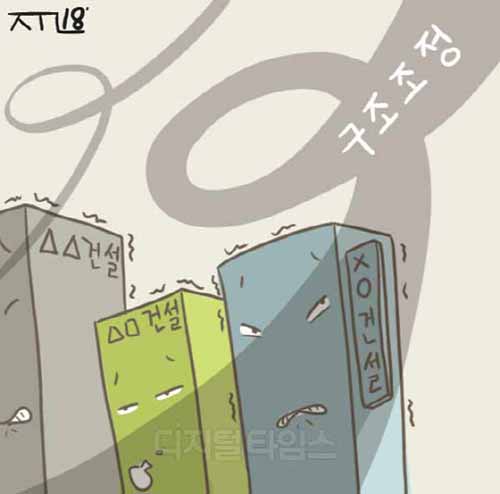

Disposal along with M&A rumor, reorganization… ‘Big4’ construction in trouble

Park Sang Gil | sweatsk@ | 2018-04-05 11:14:38

According to the construction industry on April 4, Samsung C & T has interpreted the merger between the two companies after the company moved from Pangyo to Sangil-dong Samsung Engineering building last month. The performance of Samsung C & T`s construction division has not recovered over the past three years and the number of employees continues to decline. The construction division of Samsung C & T has not undertaken a single reconstruction project since 2015. The company`s home business order backlog decreased 20% from KRW 13.29 trillion in 2015 to KRW 10.333 trillion at the end of last year. The number of employees in the construction sector, which was close to 8,000 in 2015, dropped to nearly 6,000 in September last year, nearly 2,000.

Hyundai E & C has recently been reconsidered with Hyundai Engineering. If Hyundai Motor Group merges Hyundai Engineering with Hyundai E & C or tries to roll-over Hyundai Engineering through merger in order to raise funds to start the restructuring of Hyundai Mobis, Hyundai Mobis will not raise funds through dividends or stake disposal Observations are coming out. In January, Hyundai Motor Group chose Hyundai E & C as its finance specialist.

Meanwhile, Daewoo E & C has recently replaced 14 executives, including 6 executives and 8 business executives. It seems that the failure of mergers and acquisitions (M & A) has been fruitful. KDB Bank, the major shareholder of the company, plans to close the new president and chief financial officer by June and then make additional executive greetings.

Daelim Industrial has recently restructured four of its bosses in the construction and civil engineering divisions. In conjunction, the company decided to take unpaid leave for about 1,500 employees of its plant business division and organized four plant business executives. There is also concern that the company is in the process of dismissal in earnest regarding the implementation of unpaid leave. The company`s new plant orders amounted to KRW 278.1 billion last year, down to one-tenth of 2016`s KRW 2,754.9 billion.

Kim Min-hyung, a senior research fellow at the Korea Institute of Construction Industry, said, "If construction and engineering merge, there will be synergy in terms of performance and technology." However, "Reducing manpower through restructuring can lead to a vicious circle, there is a need to build and manage overseas construction manpower databases at the national level."

By Park Sang Gil sweatsk@