Robo-advisor+ Human advising ‘Hybrid assets management’ in boom

Kim Min Soo | minsu@ | 2018-01-24 10:55:25

Robot advisor service, in which robots manage assets through mobile devices or PCs instead of humans, is particularly active in the United States. In particular, the `cooperative relationship` for mutual win-win between large financial corporations and fin tech companies in the US has settled, and it is evolving into the `hybrid type robot advisor`.

According to the recent report by the Financial Investment Association of Korea, "Digitalization trends and case studies of global financial investment industry," the US is rapidly increasing its AI-based digital financial services to about 83% It is spreading.

According to market researcher Statista, the US market for robot advisors is expected to grow from $ 126.1 billion in 2016 to $ 1.60 billion in 2021. The number of users in the same period is estimated to increase from 5.7 million to 95.4 million.

The US RoboAdviser market has grown rapidly since the start of the pin tech start-up that emerged after the financial crisis such as Betterment and Personal Capital. In particular, large financial companies such as Vanguard and Charles Schwab, which launched the service in 2015, quickly overwhelmed the market based on their strengths such as customer base, brand awareness, track record and other product linkages, .

As of the end of February last year, Vanguard, Charles Swap, $ 7 billion, Wells Front $ 5 billion, and Personal Capital $ 3 billion were listed in top 5 global top 5 robot advisor assets.

Charles Swap and Vanguard have entered the robotic advisor market, which is focused on pin-tec start-ups, and a number of global financial companies have been participating in the market competitively through the acquisition and partnership of Pin Tech.

BlackRock has entered the global market with its acquisition of Future Adviser in 2015 and is seeking to enter the European market by acquiring a stake in Scalable Capital, a European mobile operator last year. Goldman Sachs took note of the growth potential of the retirement pension market and acquired Honest Dollar, an adviser to the retirement pension professional. Invesco acquired Jempstep, TIAA acquired MyVest, and Legg Mason acquired Financial Guard. Invesco acquired Jempstep, TIAA acquired MyVest, and Legg Mason acquired Financial Guard.

There are financial companies that enter the RoboAdvisor market through partnerships rather than competition with PinTech.

UBS America has signed a strategic alliance with SigPig, a rover adviser, to build a robotic platform to serve approximately 7,000 advisories. Wells Fargo has also partnered with SigPig to develop RoboAdvisor service, Intuitive Investor `.

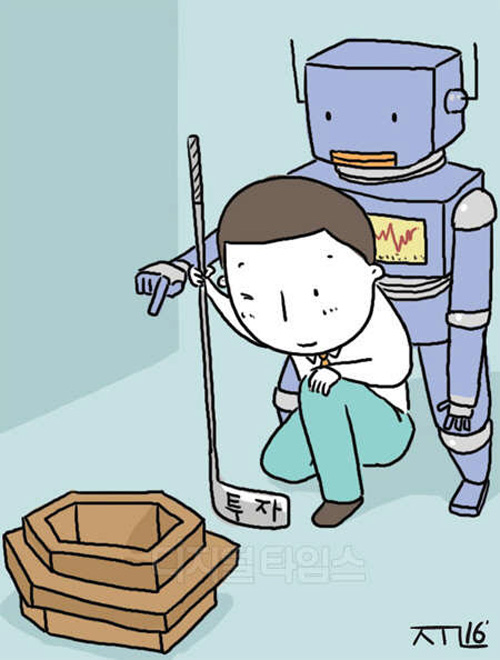

Especially in the United States, hydride type robot advisor has been increasing in recent years.

A number of companies, including rover adviser veterans and Charles Swap, are now launching a hybrid robo-advisor service to meet investor advisory needs.

Veterant has launched the `Betterment Plus` service, which allows portfolio managers to advise asset management personnel once a year. This service requires an additional fee of 40bp compared to existing services, and you can continue to receive expert advice by paying an additional 10bp.

Charles Swap, on the other hand, launched Schwab Intelligent Advisory, a hybrid robo-advisor that combines legacy services with advice from wealth management experts last year, following the launch of Schwab Intelligent Portfolios, a pure robo advisor in 2015. Released. The service provides regular or on-demand consultations with wealth management professionals through wired or video calls at the time of sign-up. The initial investment is $ 25,000 and the pay is 0.28%.

In the past, it was common to invest in stocks and bond ETFs targeting the affluent and younger generations, but in recent years, some companies have provided differentiated services by focusing on target groups.

Ellevest, one of the global promising pin-tec companies, is providing ETF-based automated disbursement services as a robo-advisor specialized for female customers. Ellevest reflects the unique characteristics of women such as high average life expectancy, low average wages and consumption saving behavior when allocating assets.

Meanwhile, Invest.com, another FinTech company, has introduced an alternative investment product specialist adviser that makes it easier for ordinary investors to invest in alternate investments that were formerly reserved for institutional investors and wealthy investors.

Besides, Investify selects the theme of investment that customers are interested in, such as robust, value investment, aging, and socially responsible investment, and introduces a theme-based RoboAdviser that invests each portfolio`s investment profile Munnypot introduced a RoboAdvisor, which provides advisory services in a chat window based user interface (UI) for making investment decisions.

"The digitization of the global financial investment industry is rapidly progressing in the area of overall business," said Seo Young-mi, a researcher at the Planning and Research Institute of the Financial Investment Association of Korea. "Various innovative business models are emerging.

By Kim Min Soo minsu@