Credit loan to go up thanks to mortgage loan limitation…A bank loan in ‘Balloon effect’

Cho Eun Guk | ceg4204@ | 2017-11-03 10:05:56

5 largest banks October household loan growth

Housing mortgage growth slowed last month due to the government`s announcement of real estate measures and measures against households, but personal credit loans have surged.

Seasonal factors such as the autumn balloon effect along with the decrease in the bourse limit were analyzed as the reasons for the increase in credit lending.

According to the two-day banking system, the top five major banks including Shinhan & National, Woori, Hana, and Nonghyup Bank totaled KRW 521.18 trillion at the end of October. This was an increase of 0.74 % (KRW 3 trillion 819 billion) from the delivery, which is higher than the 0.59 percent (3.31 trillion won) increase in September. As for the household loans by bank, Shinhan Bank and Hana Bank decreased in growth rate, and the people, Korea and Nonghyup Bank grew more and more.

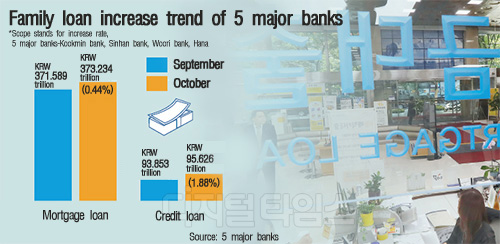

Mortgage loans, which account for the majority of household loans, stood at KRW 373.234 trillion, up 0.44 % (KRW 1.64 trillion) from September. It was 0.26 % points lower than the 0.70 % increase in September (KRW 0.2578 trillion).

Meanwhile, credit loans decreased slightly in September, but increased sharply in October. As of the end of October, credit lending increased by 1.88% (KRW 1.7792 trillion) from the previous month to 95.662 trillion won. More than 100 billion won more than mortgage loans. 8 & 2 Although the users refrained from using mortgage loans due to concerns about implementation of the real estate measures and the comprehensive measures for the household debt, it is believed that credit demand grew as the demand for funds increased due to the autumn holiday season and Chuseok holidays. A financial official said, "Although the use of real estate measures has decreased due to the decrease in the main bourse limit, it seems that the size of credit has increased due to the seasonal factors with the balloon effect."

Shinhan Bank and Hana Bank decreased household loan growth as for the increase of loans by bank. As of the end of October, Shinhan Bank recorded KRW 97 trillion in household loans. This is an increase of 0.82% (KRW 791.3 billion) from the previous month but lower than the 1.02% (KRW 976.9 billion) increase in September. Hana Bank also showed a 0.50% increase in household loans in October, and the rate of growth fell 0.15 percentage point from the previous month. On the other hand, Kookmin Bank, Woori Bank and Nonghyup Bank recorded 1.08%, 0.51% and 0.70% respectively, increasing 0.35%, 0.44% and 0.23% points respectively compared with September. All five of the banks` credit loans increased sharply. In particular, Kookmin Bank posted 2.68%, the highest increase in credit, followed by Woori Bank with 2.22%.

By Cho Eun Guk ceg4204@