‘Fierce competition among 5 simple payment service providers’…Pie of simple payment service to get bigger

Jin Hyun Jin | 2jinhj@ | 2017-04-13 10:45:15

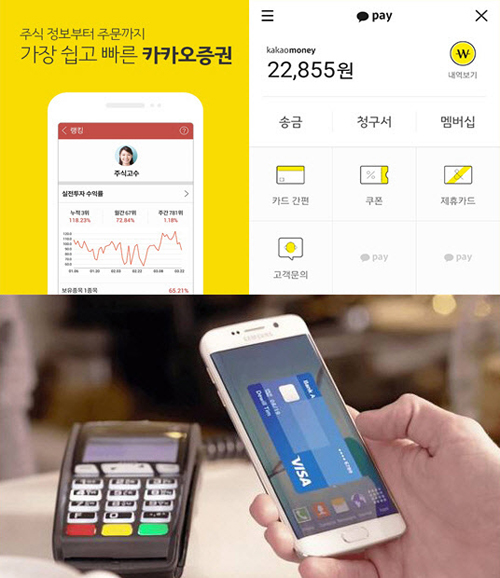

’Payco’ of NHN Payco. Photo by NHN Payco

‘Kakao Pay’ of Kakao. Photo by Kakao

‘Samsung Pay Mini’ app of Samsung Electronics. Photo by Samsung Electronics

It is expected that Google will launch Android pay in the coming months in the middle of domestic simple payment service is centered on Samsung Pay, Naver Pay, Kakao Pay, and Payco. As a result, the ‘fierce competition among 5 payment providers’ will be launched in the domestic simple payment service market.

According to the Bank of Korea`s use of electronic payment service in 2016, the use of simple payment service in the fourth quarter of last year was about KRW 40 billion, which is three times more than the KRW 13 billion in the first quarter of last year. The number of simple payment usage increased from 442 200 in the first quarter of last year to 1,236,300 in the fourth quarter.

Meanwhile, Google Android Pay came in contact with domestic credit card companies. According to the credit card industry, Google is cooperating with credit card companies such as Hyundai • Shinhan • Lotte • Hana Card to aim for domestic launch in May. AndroidPay supports payment by Near Field Communication (NFC) technology on mobile devices equipped with the Android operating system (OS). However, as offline NFC payment technology is limited to domestic penetration rate of 5%, it is likely that Google may advance into the online payment service area, industry expert said.

Domestic simple payment service is focusing on attracting users by crossing on and off line. Samsung Electronics has recently launched `Samsung Pay Mini`, which enables users to download app from all Android devices beyond the simple payment service that was only available on their smartphones. Earlier, Samsung exceeded the estimated transaction amount of KRW 4 trillion by using only Magnetic Security Transmission (MST, supported by most credit card payment terminals). A company representative said, ‘We are trying to establish `Rewards` service, which adds `shopping` function to Samsung Pay app and provide benefits according to performance, as a `wallet`.

Naver Pay of Naver posted a trading value of KRW 1.3 trillion in the last quarter. According to the company, Naver Pay grew mainly around online shopping mall payment, but it can also be utilized in `Naver Reservation` service, which can be used for reserving performances and restaurants. Especially, in April of last year, it was not restricted to online, but extended 세 the `Naver Pay check card`, which earns 1% regardless of when and where it was used.

Kakao Pay of Kakao exceeded the cumulative payment transaction value of KRW 1.60 trillion. Kakao Pay provides various functions such as simple remittance and payment of utility bills in addition to simple settlement service. In particular, Kakao planned to inject Kakao Pay on April 3 to accelerate the payment of merchants and offline payments. The company plans to work with Alipay to integrate its payment system and merchants, as it has invested USD 200 million (about KRW 230 billion) from its parent company, Ant Financial Services Group, in China. Alipay has more than 34,000 online and offline merchants in Korea.

`NHN Payco`, which became an independent corporation in NHN Entertainment on April 1, exceeded KRW 1.2 trillion as of the end of February and aims to exceed KRW 2 trillion this year. The company plans to expand its service area in cooperation with mid to large-sized merchants’ offline and open market online. The plan is to expand the offline payment area focusing on `Dongle`, a special payment terminal for Payco, and to become an `app portal` with benefits such as in-app coupons. Jeon Yeon-hoon, CEO of NHN Payco, said, ‘In this year, we will showcase a variety of services such as brand gift shops, tax payment, transportation, and bookings.’

By Jin Hyun Jin 2jinhj@