Chinese LCD to follow up Korea….Even OLED not in safe zone

Park Seul Gee | seul@ | 2017-04-07 10:46:54

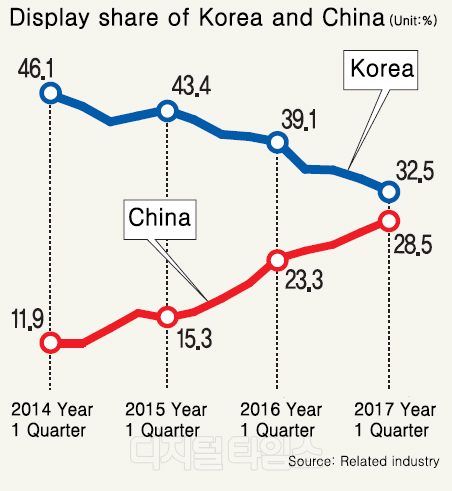

Korea`s status as the world`s No. 1 display country seems to be collapsing. Although Korea led the LCD market with a global market share of more than 50% 6 years ago, Korea has been chased by China and it seems in the midst of a reversal this year. There is no rest assured as China is in full follow up in the organic light emitting diode (OLED) display market, which accounts for more than 90% of Korea.

According to China`s SinaTech and other international press on April 6, local display maker China Star (CSOT) will invest CNY 35 billion (about KRW 5,730.9 billion) in Wuhan, China to build a 6G-generation flexible OLED production facility. The company plans to introduce a low-temperature polysilicon (LTPS) backplane process to secure a production capacity of 45,000 sheets per month. The company plans to start trial production in the second quarter of 2019 and mass-produce the product in the first half of 2020. It is intended to produce OLED panels for smart phones and tablet PCs, in the size of 3 to 12 inches.

Earlier, BOE has begun investing in flexible OLEDs among Chinese manufacturers and the company is expected to start mass production from the end of this year. BOE is building small and medium-sized OLED production facilities in Chengdu and Mianyang, Sichuan Province, China, with CNY 100 billion (about KRW 16.5 trillion). The company is aiming to start the 6th generation flexible OLED equipment ``B7`` at the end of this year at a scale of close to 50,000 sheets per month in Chengdu. The company began production line of flexible OLED construction in December of last year in Mianyang and plan to mass-produce the product in the same volume as B7 from 2019.

Chinese display makers are making a big investment in OLED, which currently is a big threat to the Korean OLED industry. It is clear that Chian will rapidly increase its market share by driving capital and solid domestic market like LCD. Currently, small and medium-sized OLEDs are dominating the market with 96% of Samsung Display and 99% of LG Display``s large OLEDs.

The LCD market leadership, where Korea used to rank first, has already moved to China. 46.1% of Korean LCD companies such as LG Display and Samsung Display were in the global LCD market in the first quarter of 2014 and 11.9% of Chinese companies such as BOE, China Star and CEC Panda were dominated by Korea. However, China has doubled its market share to 28.5% in the first three quarters of this year, narrowing its gap with Korea to 4%.

The industry expects that China will outperform Korea in LCD market this year. This is because Samsung Display stopped operating its 7th generation LCD production facility L7-1 at the end of last year and convert it to 6G flexible OLED, and shut down its 5th generation LCD production facility- L6. LG Display is not yet planning to invest more in LCD production facilities.

Meanwhile, China``s LCD power is becoming increasingly prevalent. BOE will start mass production of 10.5G LCD in the third quarter, next year and ChinaStar will start operating 11G plant from 2019. And China is expected to dominate the LCD market from next year.

It is pointed out that the Korean display industry needs to change strategically as China, which has broken the Korean market in the LCD market and has moved to the position of an OLED leader. If Korea does not make strategic solution LCD market leadership may move to China like steel, shipbuilding industry. A display industry expert said, ‘One 10.5G line is similar to two 8.5G lines with LCD shipment. When China enters the 10.5G LCD, we have to build production facilities that are able to exceed the Chinese facilities.’

By Park Seul Gee seul@