Smartphone in cooperation with EV…Samsung Electro-Mechanics & SDI performance expected to be double

[ Park Jung Il comja77@ ] | 2017-09-08 11:06:02

Samsung SDI and Samsung Electro-Mechanics, which had not been able to keep up with the sluggish performance until early this year, caught up with a chance of earnings recovery. Next-Generation Strategies of Samsung Electronics and Apple We expect both sales and profit to rise in line with the supply of smartphone parts and the growth of new businesses such as electric vehicle batteries.

According to the industry on September 7, Samsung Electro-Mechanics is reported to be working on the next generation main substrate SLP (Substrate like PCB), which is expected to be applied to next-generation smart phones of SEC and Apple.

SLP is a smart phone main board that applies semiconductor process to high density multilayer board (HDI) that is applied to many smart phones now. It has the advantage of space utilization, which is about half the size of conventional ones, which helps to increase battery capacity.

An industry expert said, "We know that existing PCBs are very competitive with Chinese companies. However, SLPs can only be manufactured by a small number of companies. It is also known that SLP will be applied to the next iPhone.”

Samsung Electro-Mechanics` (ACI) division`s sales declined to KRW 1.33 trillion last year from KRW 1.33 trillion in 2015 due to intensified competition with Chinese companies.

Samsung SDI is also expected to see a recovery in earnings as it is forecasting that it will supply some batteries to the next iPhone following the recently released Galaxy Note 8. Also, as Apple is expected to use organic light emitting diode (OLED) displays in its next model, demand for related materials such as green phosphorescence produced by Samsung SDI is also expected to increase. Besides, the mid-to large-sized battery business, which is a future strategic business, should see a significant loss of losses due to the growth of the electric vehicle and electric power storage (ESS) business. According to market researcher SNE Research, as of the end of July, Samsung SDI`s electric vehicle battery shipments this year increased 89.1% from the previous year.

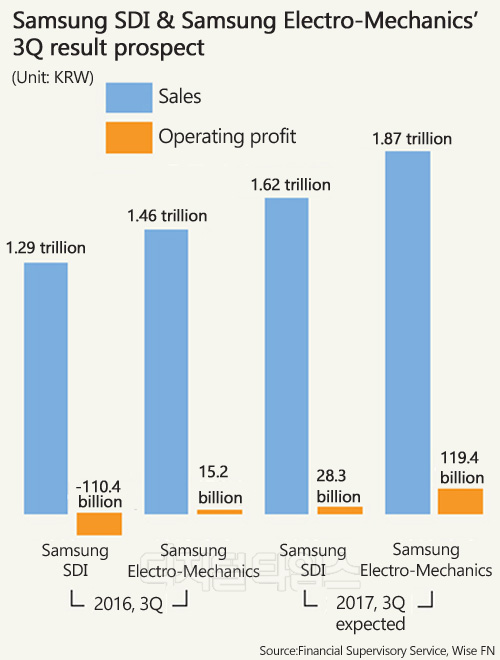

For these reasons, both companies` third quarter earnings prospects are bright. According to financial information company WiseFean, SEMCO`s the third quarter operating profit forecast is KRW 119.4 billion, which is expected to reach KRW 100 billion in eight quarters. Samsung SDI’s third quarter operating profit estimate is expected to continue to rebound to KRW 28.3 billion on an operating profit of KRW 5.5 billion in the second half.

By Park Jung Il comja77@