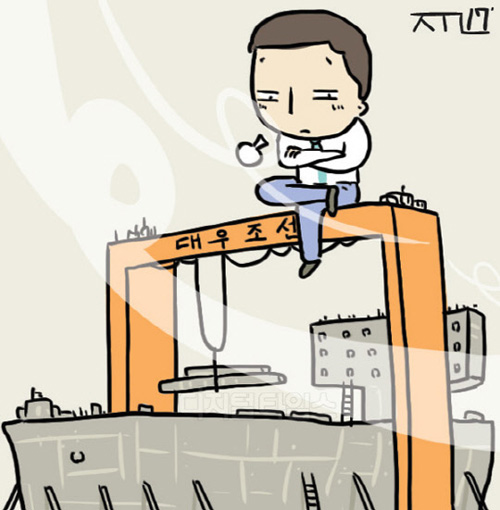

payers’ money in DSME. Will company keep its promise on offshore plant issue?

Yang Ji Yun | galileo@ | 2017-05-24 12:17:05

Park Geun-hye, the former government and the state-owned bank, added KRW 2.9 trillion to DSME, and the promise that the offshore plant business actually collapsed and there is concerns that the issue will become a ‘black hole’. The market has been snagging as the offshore plant orders have resumed As expectations for an upturn in international oil prices, which had been weak for some time, have increased. Daewoo Shipbuilding & Marine Engineering’s order receipts are becoming a source of concern as it can not only reverse the government`s promise of volume reduction but also lead to low-priced orders that are hard to meet profitability.

According to the shipbuilding industry on May 23, Hyundai Heavy Industries, Daewoo Shipbuilding & Marine Engineering, Samsung Heavy Industries, so-called `Big 3` shipbuilders recently have participated in qualification screening (PQ) of the gas project `Block B`, which is a subsidiary of Petro Vietnam. The preliminary qualification screening is in the pre-bidding stage. The shipbuilders that have passed the preliminary qualification screening will submit the bid proposal to the ordering party and conclude the contract through the procedure such as the person to be the preferred bidder. The block B project is about KRW 1 trillion and Shipbuilder Big 3 is pushing to participate in the bid for the production facilities at the top of the offshore gas production facility (CPP).

That is not all. Daewoo Shipbuilding is currently bidding with Hyundai Heavy Industries, Samsung Heavy Industries, and overseas shipyards in order to win contracts for the Floating Bulk Oil Production Facility (FPSO) hull of Norway`s oil company, Statoil. Chung Sung-lip, president of Daewoo Shipbuilding, also participated in the offshore plant project in the marine plant industry, attending the `2017 Ocean Plant Equipment Fair (OTC)` held in the US last month.

The problem is that plan of "small but solid company, DSME," and it is positioned with the original idea of the financial authorities, who wanted to find a owner for DSME. In a briefing after the ministerial meeting on industrial competitiveness enforcement in March, Lim Jong-ryong, head of the finance committee, pointed out, "We plan to reorganize DSME by restructuring the offshore plants and restructuring them with a focus on competitive merchant ships and special ships." The plan to sell the company in 2018 by reducing the size of Daewoo Shipbuilding and making Hyundai Heavy Industries and Samsung Heavy Industries a "two-for-one" system. On the other hand, the Korean government has decided to support KRW 2.9 trillion for the controversy over additional tax money. The largest shareholder of DSME, KDB Industrial Bank CEO Lee Dong-geol, said on the same day, "We will keep DSME from participating in the offshore plant sector." However his promise is not being met.

Therefore, it is doubtful whether the government`s plan to reduce sales of DSME to KRW 6 ~ 7 trillion, half of what it is now, will be effective. The Ministry of Commerce, Industry and Energy, which had disagreed with the financial authorities on the issue of disposal of DSME, was said to have had a negative view on DSME`s new offshore plant order.

One government official mentioned, "The Company should stop accepting new orders for its offshore plants in order for DSME to reduce its outlook. If the related projects are not sorted out, the "two-for-one" system cannot be guaranteed.”

By Yang Ji Yun galileo@